AAA Auto Insurance remains a trusted choice for millions of Americans, offering a combination of legacy service, member-exclusive perks, and comprehensive insurance options. As a federation of regional motor clubs, AAA offers localized service under a unified national brand. With a history spanning over a century, AAA continues to attract new customers through benefits like roadside assistance, bundling discounts, and personalized coverage options.

A Look Back: The History and Legacy of AAA

Founded in 1902 by nine motor clubs advocating for better road infrastructure, the American Automobile Association (AAA) has grown into a household name in travel and auto insurance. Initially focused on road safety, AAA quickly expanded its services to include travel planning, vehicle servicing, and auto insurance, becoming a one-stop solution for car owners across the U.S.

Who Runs AAA? Meet the CEO and Leadership

As of 2024, Gene Boehm serves as the President and CEO of AAA. With a strategic focus on digital transformation and member satisfaction, Boehm continues to lead AAA into the future. Under his leadership, AAA is enhancing its tech platforms, improving claims processing, and streamlining services for a more connected customer experience.

Legal Controversies and Consumer Complaints: What You Should Know

While AAA enjoys a largely positive reputation, it has faced some legal scrutiny over the years. In 2016, a lawsuit in California targeted AAA for allegedly mishandling policy cancellations. More recently, in 2022, a class-action suit claimed CSAA (AAA Northern California) overcharged policyholders during the pandemic. Though these incidents were limited to specific regional affiliates, they highlight the importance of understanding your local club’s terms and practices.

How AAA Makes Money: Is It Worth Your Premium?

AAA operates as a not-for-profit federation, reinvesting profits into member services. Instead of paying dividends to shareholders, AAA focuses on lowering premiums, improving customer support, and expanding coverage options. This model may benefit customers seeking long-term value over aggressive cost-cutting.

Is AAA Auto Insurance Available in Your State?

AAA serves all 50 U.S. states through various regional motor clubs. Each club operates semi-independently, which can lead to variations in coverage, pricing, and service quality.

| State | AAA Club Name | Club Code |

|---|---|---|

| California | AAA Northern California, Nevada & Utah | NCNU |

| Texas | AAA Texas | TXAA |

| Florida | Auto Club South | ACS |

| New York | AAA Northeast | AANE |

| Michigan | The Auto Club Group | ACG |

| Illinois | AAA Chicago | CHAA |

| Georgia | AAA Georgia | GAAC |

| Ohio | AAA Ohio Auto Club | OHAA |

| Arizona | AAA Arizona | AZAA |

| Pennsylvania | AAA Mid-Atlantic | MAAA |

| North Carolina | AAA Carolinas | CAAA |

| Washington | AAA Washington | WAAA |

| Oregon | AAA Oregon/Idaho | ORID |

| Nevada | AAA Northern California, Nevada & Utah | NCNU |

| Utah | AAA Northern California, Nevada & Utah | NCNU |

What Exactly Does AAA Auto Insurance Cover?

AAA offers a full spectrum of auto insurance coverage:

- Liability for bodily injury and property damage

- Collision for at-fault accident repairs

- Comprehensive for non-collision incidents (theft, weather, etc.)

- Uninsured/Underinsured Motorist Protection

- Medical Payments and PIP (Personal Injury Protection)

- Gap Insurance for leased vehicles

- Rental Reimbursement and Roadside Assistance

AAA Discounts You Might Be Missing

AAA offers numerous discounts that can drastically reduce your premium:

- Safe driver and accident-free record

- Multi-policy (home, renters, life)

- Good student discount

- Anti-theft devices

- Paid-in-full and paperless billing

- AAA membership longevity

AAA vs Geico vs Progressive: How Do They Compare?

AAA is best known for including roadside assistance, a feature other insurers typically charge extra for. Here’s a quick comparison:

| Feature | AAA | Geico | Progressive |

|---|---|---|---|

| Roadside Assistance | Included | Optional Add-on | Optional Add-on |

| Local Office Support | Yes (regional) | Limited | Limited |

| Discount Variety | High | High | Moderate |

| Online Claims | Yes | Yes | Yes |

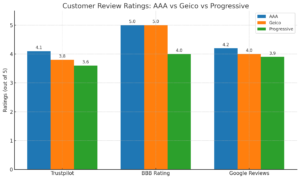

Customer Review Ratings: AAA vs Competitors

| Source | AAA | Geico | Progressive |

|---|---|---|---|

| Trustpilot | 4.1/5 | 3.8/5 | 3.6/5 |

| BBB Rating | A+ | A+ | A |

| Google Reviews | 4.2/5 | 4.0/5 | 3.9/5 |

Is AAA Open on Holidays? What to Expect Year-Round

Most AAA offices are closed on national holidays including:

- New Year’s Day

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving

- Christmas

However, roadside assistance remains active 24/7, 365 days a year.

How to Contact AAA Auto Insurance

If you need to get in touch with AAA for any queries, claims, or support, here’s everything you need:

Headquarters Address:

AAA National Headquarters

1000 AAA Drive, Heathrow, FL 32746, USA

Customer Service Phone Numbers:

General Inquiries: 1-800-222-4357

Claims Support: 1-800-672-5246

Roadside Assistance: 1-800-AAA-HELP (1-800-222-4357)

Real Customer Experiences: What the Reviews Actually Say

AAA customers praise its:

- Fast roadside assistance (often under 30 minutes)

- Friendly local agents

- Quick claims service

Some concerns include:

- Regional differences in claim processing

- Higher premiums compared to online-only providers

Sources:

Who Underwrites AAA Insurance? Behind-the-Scenes Details

AAA does not underwrite its own policies nationally. Instead, regional affiliates do. Examples:

- CSAA Insurance Group (Northern California, Nevada, Utah)

- Auto Club Insurance Association (Midwest)

- The Auto Club Group (Southeast)

This model leads to slight variations in customer service and pricing across states.

Summary: Is AAA Auto Insurance Right for You in 2025?

If you’re looking for more than just a policy — something that comes with real, tangible member benefits — AAA is hard to beat. From trusted roadside help to a century-old legacy, AAA Auto Insurance provides security, service, and savings. However, check your local affiliate to ensure you’re getting the best value.

FAQ’s:

Q1: Does AAA offer full coverage auto insurance?

Yes, AAA provides full coverage including liability, collision, comprehensive, and more.

Q2: Can I bundle AAA Auto Insurance with home insurance?

Absolutely. AAA offers multi-policy discounts when bundling home, renters, or life insurance.

Q3: Is AAA auto insurance available in all 50 states?

Yes, through regional motor clubs with localized pricing and service.

Q4: Who underwrites AAA Auto Insurance?

Policies are underwritten by affiliates like CSAA, Auto Club Insurance Association, and The Auto Club Group.

Q5: How can I contact AAA customer service?

Visit AAA.com or call your regional office. Most clubs offer 24/7 claims support.